International focus: The Peru mining cluster and sector opportunities

Peru’s mining sector is a fundamental pillar of the nation’s economy, contributing over nine per cent of the country’s GDP and representing 62 per cent of its export revenues.

The country’s rich mineral resources and favourable geological conditions make Peru one of the world’s top mining destinations.

The level of mining investment is expected to reach US$ 5,100 million in 2024, according to projections from the Ministry of Energy and Mines. This amount is higher than in 2023, and it is estimated that the positive trend will continue over the next couple of years, although moderately.

Peru ranks as the world’s second-largest producer of copper, silver and zinc and a significant producer of gold, tin and molybdenum. According to data from the US Geological Survey, the country holds 12 per cent of global copper reserves, 3.9 per cent of gold, 15.3 per cent of silver, 9.5 per cent of zinc, 5.3 per cent of lead, and 2.8 per cent of tin. Considering its abundant mineral resources and legal framework that promotes private investment, Peru is considered an attractive destination for several countries including China, Mexico, Canada, United States, United Kingdom, Australia, Brazil, Japan, Switzerland, etc.

Australia, for example, has emerged as a key partner in Peru's mining industry, leveraging its advanced technology, expertise, and investment capacity to contribute to the sector's growth. There are several key factors for this partnership:

- Technological innovation: Australian companies are at the forefront of mining technology and innovation. They have introduced advanced techniques in mineral exploration, extraction, and processing in Peru. For example, the use of automated drilling rigs, remote sensing technology, and data analytics has helped improve operational efficiency and reduced costs.

- Investment and partnerships: Australian mining companies have made significant investments in Peru. For instance, BHP, one of the world's largest mining companies, has invested in the Antamina mine, a major copper-zinc operation, and continues to invest in exploration projects. Similarly, MMG Limited, an Australian-based company, operates the Las Bambas mine, one of the largest copper mines in the world.

- Capacity building and training: Australia has also contributed to the development of local talent and expertise through training programs and capacity-building initiatives. Australian institutions and companies offer training in best practices, safety standards, and sustainable mining techniques, enhancing the skills of the Peruvian workforce.

- Environmental and Social Governance (ESG): Australian firms are known for their commitment to high standards of environmental and social governance. They bring best practices in ESG to Peru, promoting sustainable mining practices, community engagement, and transparent operations. This approach helps mitigate some of the social and environmental challenges faced by the industry.

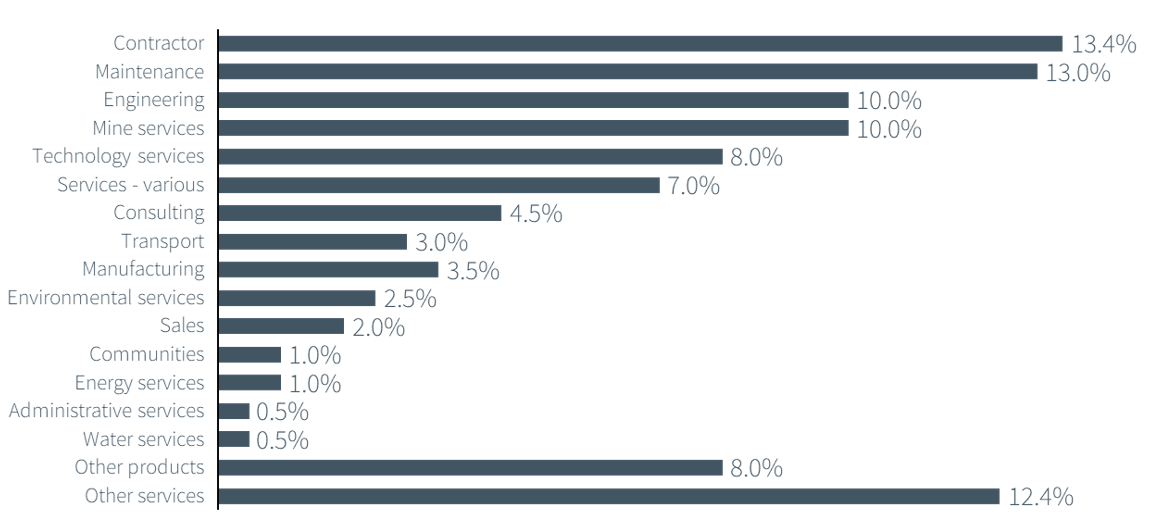

The mining sector encompasses not only mining operations but also related companies, facilities, and stakeholders. Peru has a highly specialised mining cluster, and the number of Mining Equipment, Technology, and Services (METS) companies operating in Peru is substantial, reflecting the country’s significant mining industry. Estimates suggest that there are hundreds of METS companies active in the Peruvian market, contributing significantly to the mining sector’s efficiency and productivity. These suppliers represent more than 70% of the internal spending of mining companies in the country.

Peru’s advantageous geological conditions and extensive mineral reserves attract a wide range of international METS firms. Companies from Australia in particular have an important presence, supported by the Peru-Australia Free Trade Agreement (PAFTA), which facilitates access and operations for Australian service providers. These companies are involved in various aspects, including explosives, blasting systems, and mining chemicals; equipment and tools for drilling, cutting, crushing, and automation; services specialising in mine planning, open cut and underground mining and asset management; engineering, project management, and operations solutions; real-time subsurface intelligence solutions; and more.

According to the Study of Mining Suppliers of Peru prepared by SAMMI (Andean Mining Cluster), the mining sector purchases more than US$ 10 billion from local suppliers, some of which are owned by foreign companies.

(SAMMI, 2021)

Considering Peru’s mining industry forecast, this number should increase and potentially double its size in the next ten years. According to the portfolio of mining projects presented by MINEM, Peru has 51 mining projects at different levels of progress that encompass an investment of US$ 54,556 million. The mining industry has many opportunities to keep growing over the next decade. Key factors influencing the sector include:

- Production levels: The industry is anticipated to exceed pre-pandemic production levels by the end of 2024, with a projected growth rate of at least five per cent. This is driven by the increase in production and a positive performance of Antapaccay, Anglo American Quellaveco, Antamina, and the Southern Perú Copper Corporation.

- Investment climate: Based on the portfolio of mining projects, 18 mining projects, at an estimated value of US$ 22 billion, should initiate construction during the next decade.

- Critical minerals and green technologies: Peru’s mining sector is poised to benefit from the global shift towards green technologies and the country produces at least eight of the so-called transition minerals: copper, iron, lead, molybdenum, silver, zinc, indium and graphite.

- Cost optimisation and operational excellence: In response to rising production costs and narrower profit margins, Peruvian mining companies are focusing on optimising their operations. This includes leveraging technological advancements and improving operational efficiencies to maintain profitability. The MET companies play a key role in this space.

- Regulatory and tax environment: The regulatory framework, including tax stability agreements, offers predictability for investors.

Companies prefer to invest in countries with low or moderate geopolitical risk. Peru needs to continue generating trust by demonstrating economic and political stability, effective management of its social problems, efficiency in the regulatory and tax environment, good control and governance to avoid corruption, and maintaining monetary stability and fiscal competitiveness.

The Peruvian mining value chain reflects a well-coordinated system that enhances the economic value of mineral resources, contributing significantly to the nation’s economic development while addressing environmental and social challenges.

References

SAMMI, A. M. (2021). Estudio de Proveedores Mineros del Perú. Lima, Peru: SAMMI.