New commodities, same process? Leveraging existing expertise to support critical minerals processing

Can existing expertise be leveraged to support critical minerals processing in Australia?

1. The changing landscape of the Australian resources industry

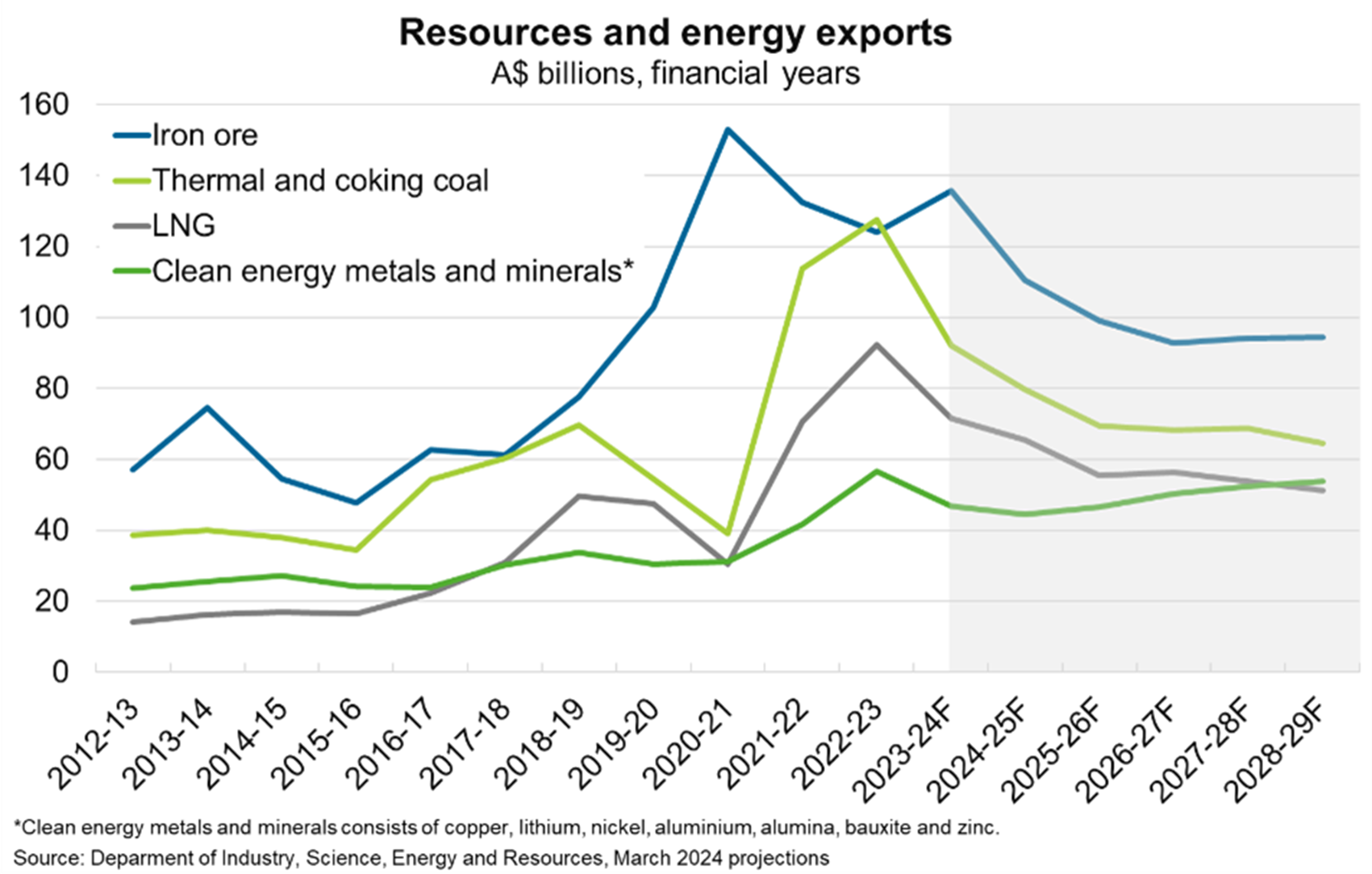

Recent forecasts by Export Finance Australia (2024) indicate steady ongoing growth in ‘clean energy metals and minerals’ exports going forward, with reducing export value due to lower prices and demand for fossil fuel exports. Structural drivers of demand for critical minerals, to support the global transition towards net zero emissions, are positive over the longer term. This is a significant opportunity for the Australian mining and METS sectors.

A significant volume of Australian minerals exports have historically focused on a direct shipped ore (DSO) model for bulk commodity exports (coal, iron ore, and natural gas), and exporting them with minimal processing. Expertise in onshore processing has been focussed predominantly on primary concentration (coal, base metals, bauxite) and gold.

This year the federal government announced plans for a Critical Minerals Production Tax Incentive, committing A$7bn over the decade to bolster the processing of critical minerals. This move is aimed at enhancing supply chain resilience and supporting the downstream refining of 31 identified critical minerals including lithium, cobalt, nickel and rare earths (Treasury, 2024).

The transition towards more downstream processing opportunities, particularly for critical minerals integral to the manufacture of modern electronics, renewable energy infrastructure, and electric vehicles, represents a ‘sea change’ for the resource sector. The move aims to maximise the value of these resources by on-shoring processing, allowing Australia to capture more value throughout the supply chain. This strategy aligns with global trends towards renewable, sustainable energy and tech industry expansion, holding promise for diversifying Australia's economy and boosting job creation.

There is great opportunity to capture the full supply chain, and any projects that expand the volume of mining and on-shore critical mineral processing, even if initially to a concentrate, will add value to the economy, and shore up supply certainty for further development of additional downstream processing.

The consultation process for the critical minerals production tax incentive took place during 2024. Specifications to determine what processing activities are eligible will be developed, which may be based on the nature and composition of the outputs from that processing, which is of keen interest to developers and investors (Critical minerals production tax incentive | Treasury.gov.au)

2. Skills for processing critical minerals

Growing a skilled workforce is a focus area of the 2023-2030 Critical Minerals Strategy, acknowledging that a skilled, diverse and growing workforce is needed to support desired growth in the sector, especially downstream processing.

According to Jobs and Skills Australia, the country has a national shortage of key professions in the industry. Skilled migration is not a reliable solution, as demand is worldwide; for instance, the US Inflation Reduction Act is stimulating significant demand for new jobs. This environment, coupled with a reluctance of young people and recent graduates to join the mining sector, present a real risk for the sector more broadly but also for the critical minerals industry.

There are key actions included in the 2023-2030 Critical Minerals Strategy to begin to address this, and action needs to be taken at both a government and industry level to improve attraction, retention and training of the workforce. However, it is important to recognise the skills that we do have in the Australian industry that can be leveraged as the critical minerals sector grows.

3. Existing skills for new commodities – comminution

Leveraging our sector’s extensive comminution circuit expertise is essential to support this growing work in critical minerals, as is drawing on commodity-specific experience. The comminution circuit utilised in critical minerals circuits, such as hard rock spodumene circuits, has a lot of similarities to typical base and precious metals hard rock comminution circuits; however, there are some key differentiators. Although common to see crushers, screens and mills within these critical minerals circuits, their mineralogy means some key process changes are required to maximise the recovery of the valuable mineral. For spodumene circuits, the comminution circuit is frequently seen as a multi-stage comminution and separation process, due to the sensitivity of the ore to overgrinding which results in a loss of recovery. Due to these characteristics, alternate flowsheets to a typical hard rock circuit should be developed, which focus on reducing overgrinding and slimes generation, whilst maximising valuable recovery.

Overgrinding is common across the majority of comminution circuits, regardless of mineralogy, and there are a number of emerging new and novel technologies being developed and trialled to reduce fines generation. These technologies are focused on the comminution and separation unit operations. Within the comminution circuit, upcoming technologies focussed on the reduction of fines generation involve novel comminution techniques as well as employing classification within the comminution device, removing particles at size before overgrinding can occur. Classification technologies are also important in the reduction of slimes generation and overgrinding, as poor classification leads to the return of particles back to the comminution circuit, exposing them to further grinding. Novel classification technologies are aiming to reduce water and density effects in water-based separation technologies (hydrocyclones) which should directly impact the amount of misclassified material.

4. Existing skills for new commodities – dense media and gravity circuits

For many of the focus commodities for the energy transition, the concentration step generally uses unit processes that are very familiar to existing processing specialists in Australia.

Dense media separation (DMS) and flotation circuits have been the mainstay of coal processing throughout Australia since the mid 1970s. There has been extensive development in DMS and medium recovery circuitry across this period. Expertise in dense media recovery is key to lowering operating costs for these types of circuits. The coal industry was also a widespread early adopter of column flotation technologies such as Jameson Cells and Microcels. Adding mid-size circuitry with spirals in the mid 1980s and upcurrent classifiers such as reflux classifiers and teetered-bed separators in the early 2000s. The technology development in this and other bulk commodities continues to permeate through the wider minerals sector.

As an example, there are several iron ore, base and precious metal plants that have installed high density FeSi (Iron-silica) based DMS circuitry as ore pre-concentrators. Australia also has a significant history with applying fines technologies (spirals and upflow classifiers) across the mineral sands sector, and more recently for upgrading lower grade or below water table BWT feeds of some of the Western Australia iron ore deposits (spirals, upcurrent classifiers, wet high intensity magnetic separators (WHIMS)). Beneficiation of iron ore prior to shipping is likely to increase, as quality specifications of ore for direct-reduction ‘green’ steel production are higher than for existing furnace technology.

Many of the existing minerals processing plants, across a spread of commodities, also already include the ancillary circuitry essential for this style of primary wet processing including coarse, fine and ultrafine screening, classifying cyclones, thickeners and filtration. The new critical minerals processing circuits all leverage these same technologies although with potentially tweaked design parameters and throughput capacities.

The current equipment suppliers, plant designers and operators bring with them significant experience of what they already know and do with respect to primary processing of minerals. The key is leveraging that knowledge across new commodities and modified processing strategies, and more importantly, into the more complex downstream processing.

Skills for further downstream processing

Further downstream processing, post concentration, can use a variety of unit processes, and require specialist expertise and materials selection. Processes can include calcination, acid roast, solvent extraction, leaching, and precipitation / crystallisation. There are pockets of expertise in Australia, but this is definitely an area that will need additional skilled workforce as the sector grows. Detail on these stages is outside scope of this article, but the Critical Minerals Conference by AusIMM in Brisbane in August this year was a great showcase of technical expertise in this field.

Conclusion

In Australia, we have more skills than we often appreciate, and this will and allow us to get beyond the “dig and ship” nation that we have been, but therein lies the challenge to retain our massive export earnings business while we do that. Many unit processes required to extend the onshore value chain are embedded in mine owners and service providers, who also have had significant exposure to international capability. What has been missing is the opportunity to exercise and hone these skills for onshore projects as we have continuously exported the value chain into our international markets. This is where incentive and collaborative development programs are required to support our acceleration and economic development.

For some key critical mineral processes we do have the skills in Australia, for others, including final rare-earth element (REE) processing, support from professional expertise in other countries is needed to supplement our skills base. However, we do need to grow the skills based to realise the volume of work that we are looking to deliver.

We have seen reductions in enrolments in key engineering and mining disciplines, so an increase in attraction and ongoing investment in research and development as well as training is essential to keep pace with the evolving landscape of sustainable mining and critical mineral processing.

References

Department of Industry Science and Resources, 2023. 'Critical Minerals Strategy 2023–2030' [online]. Available from: https://www.industry.gov.au/publications/critical-minerals-strategy-2023-2030/our-focus-areas/6-growing-skilled-workforce

Export Finance Australia, 2024. 'Australia—Long term critical minerals’ export prospects remain intact' [online]. Available from: https://www.exportfinance.gov.au/resources/world-risk-developments/2024/april/australia-long-term-critical-minerals-export-prospects-remain-intact/

Treasury, 2024. Investing in a Future Made in Australia [online]. Available from: https://ministers.treasury.gov.au/ministers/jim-chalmers-2022/media-releases/investing-future-made-australia

Treasury, 2024. 'Critical minerals production tax incentive' [online]. Available from: https://treasury.gov.au/consultation/c2024-541266